Introduction

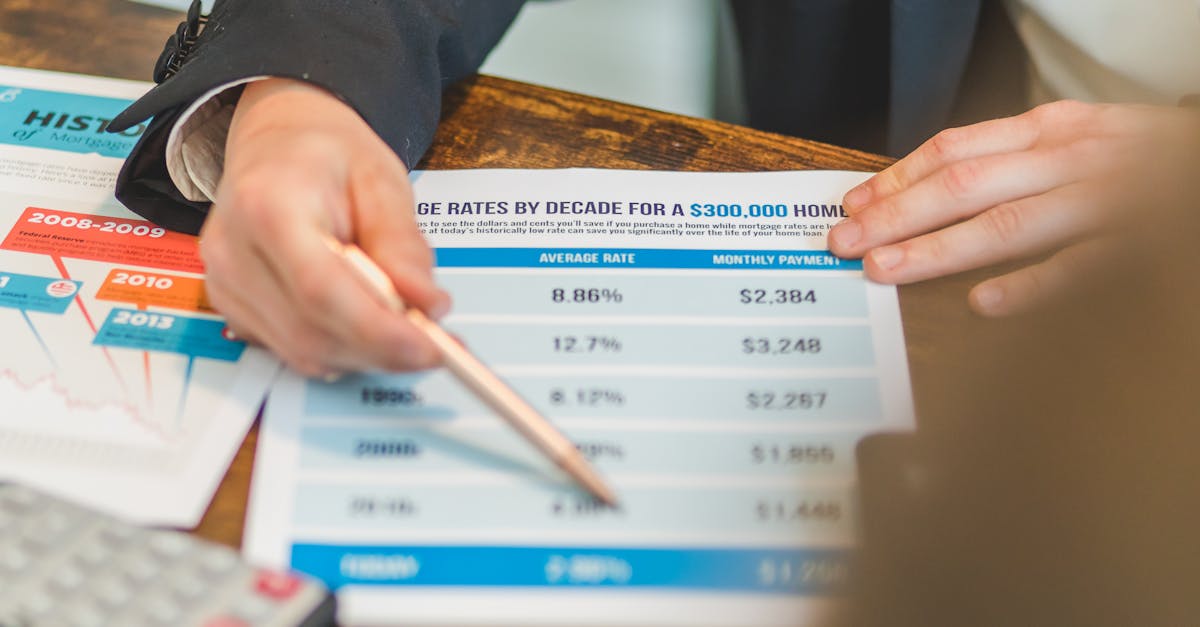

Interest rates play a crucial role in determining the cost of borrowing, especially when it comes to mortgages. They influence the monthly payments you make on your home and can significantly affect the total amount you pay over time. Understanding the impact of interest rates on your mortgage can help you make more informed financial decisions.

What is an Interest Rate?

An interest rate is essentially the cost of borrowing money, expressed as a percentage of the loan amount. It compensates the lender for taking the risk of lending you the money. In the context of mortgages, the interest rate determines how much extra you'll pay on top of the principal amount you borrowed. Lenders set these rates based on several factors, including market conditions and borrower creditworthiness.

How Interest Rates Affect Monthly Payments

The interest rate you secure on your mortgage will directly affect your monthly payments. A higher interest rate means you'll pay more each month, while a lower rate results in more affordable payments. This is because a significant portion of your payment goes toward covering the interest accumulated on your loan as opposed to reducing the principal.

Fixed vs. Variable Rates

Mortgages can come with either fixed or variable interest rates. A fixed-rate mortgage means the interest rate remains consistent throughout the loan term, providing predictable monthly payments. In contrast, a variable rate, often called an adjustable-rate mortgage (ARM), changes periodically based on market conditions, which can mean your payments may fluctuate over time.

Impact on Loan Terms

The interest rate also affects the overall loan term. A higher rate might incentivize choosing a longer-term mortgage to reduce monthly costs. Conversely, lower rates may allow borrowers to opt for shorter terms, saving on interest over time. Understanding your rate can help you select the loan terms that best suit your financial situation.

Economic Factors Influencing Rates

Economic factors like inflation, employment rates, and central bank policies can influence interest rates. When the economy is strong, central banks may increase rates to prevent inflation. In contrast, during economic downturns, they might lower rates to encourage borrowing and investment. Being aware of the economic climate can help you anticipate changes in interest rates.

Credit Score Considerations

A borrower's credit score is a key determinant in the interest rate offered. Higher scores generally lead to more favorable rates, translating to better mortgage terms and savings over the duration of the loan. Improving your credit score before applying for a mortgage can secure a lower interest rate, reducing the cost of your home over time.

Refinancing and Interest Rates

Refinancing your mortgage can be a strategic move to take advantage of falling interest rates. By refinancing at a lower rate, you can reduce your monthly payments and the overall interest paid throughout the loan's life. However, one must consider closing costs and fees associated with refinancing, which can offset potential savings.

Planning for Rate Fluctuations

While interest rates can seem intimidating, planning for fluctuations is essential. By budgeting for possible rate increases, especially for ARMs, you can avoid financial stress if your payments rise. Establishing an emergency fund and reducing debt can help cushion any financial impact from future rate changes.

Conclusion

Interest rates are a pivotal factor in the mortgage landscape, affecting everything from monthly payments to the total interest paid. By understanding these impacts and considering economic factors, borrowers can make informed decisions when choosing a mortgage. Whether buying a home or refinancing, being proactive about interest rates ensures long-term financial sustainability.