Introduction

Investing in rental properties can be a lucrative opportunity, but determining the success of such an investment requires more than just collecting rent. Calculating the return on investment (ROI) helps investors understand their property's profitability. This article will guide you through the process of effectively calculating your ROI on rental properties.

RDNE Stock project/Pexels

Key Concepts of ROI

ROI, or Return on Investment, is a financial metric used to evaluate the efficiency of an investment. In real estate, ROI measures the return generated from a rental property compared to its cost. By understanding ROI, investors can make informed financial decisions that contribute to long-term success.

MART PRODUCTION/Pexels

Calculating Costs

The first step in calculating ROI is identifying the total cost associated with the property. This includes purchase price, closing costs, and renovation expenses. Ongoing costs such as property taxes, insurance, and maintenance must also be considered. Accurately accounting for these expenses is vital to achieving an accurate ROI measure.

RDNE Stock project/Pexels

Rental Income

The next phase involves determining the property's potential rental income. Analyze market trends, compare similar properties in the area, and estimate monthly rent. Remember to include any additional sources of income, such as parking fees or laundry services. Establishing a realistic rental income baseline is crucial for calculating the property's profitability.

Tima Miroshnichenko/Pexels

Net Operating Income

Net Operating Income (NOI) is calculated by subtracting operating expenses from rental income. Operating expenses include property management fees, utilities, repair costs, and other expenses necessary to maintain the property. The NOI is a critical component of calculating ROI, reflecting the property's ability to generate income.

Tima Miroshnichenko/Pexels

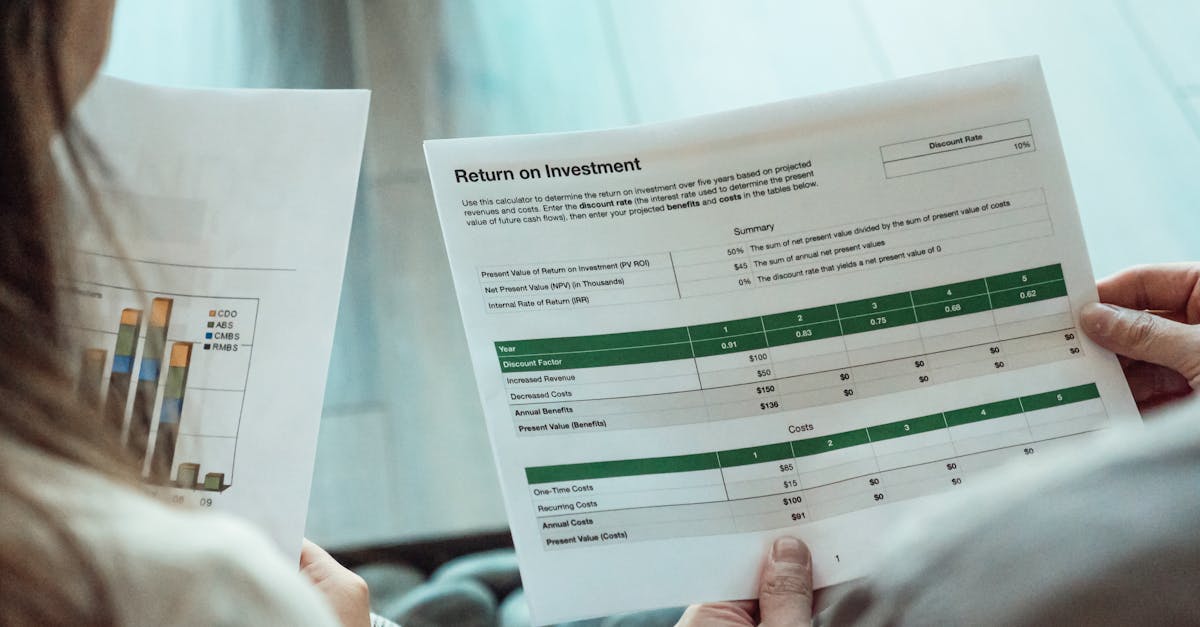

Determining ROI

To calculate the ROI, divide the annual net operating income by the total investment cost, and multiply the result by 100 to get a percentage. For example, if your total investment cost is $200,000 and your annual NOI is $20,000, the ROI would be ($20,000 / $200,000) x 100 = 10%. A higher ROI indicates a more profitable investment.

Kindel Media/Pexels

Understanding ROI Implications

A thorough analysis of ROI provides insights into the property's performance and helps investors plan their strategies. A positive ROI indicates profitability, while a negative ROI suggests reconsideration of rental rates or cost-cutting measures. Investors can optimize their portfolios by focusing on properties with the best ROIs.

Alena Darmel/Pexels

Factors Influencing ROI

Numerous factors affect ROI, including property location, local market conditions, and economic changes. Stay informed about local trends, such as development plans that may impact property value. Continually reassess rental rates and invest in property upgrades that might improve the ROI over time.

Kindel Media/Pexels

Utilizing ROI Calculations

Leveraging ROI calculations is essential for making informed investment decisions. Compare the ROI of multiple properties before purchasing or selling, ensuring each decision aligns with your financial goals. Regular ROI assessments allow for timely adjustments, enhancing the profitability of your rental property portfolio.

Mikhail Nilov/Pexels

Conclusion

Calculating the ROI on rental properties is an essential part of real estate investing. By thoroughly understanding and calculating the costs, income, and other financial metrics, investors can make more informed decisions. A comprehensive approach to ROI will help ensure successful and profitable rental property investments.

Tara Winstead/Pexels